How I Tackled Medical Costs Before They Tackled Me

What happens when a routine checkup turns into a financial nightmare? I learned the hard way that healthcare isn’t just about health—it’s about money, too. After facing unexpected medical bills that nearly drained my savings, I dove into smart financial planning. This is the real talk on preparing for medical expenses the professional way—no jargon, just practical steps that actually work. It’s not about becoming a financial expert overnight, but about making thoughtful choices today that protect your family, your peace of mind, and your future. The truth is, medical costs don’t discriminate. They can affect anyone, regardless of age, income, or insurance status. And once they arrive, they rarely knock first.

The Wake-Up Call: When Health Meets Financial Reality

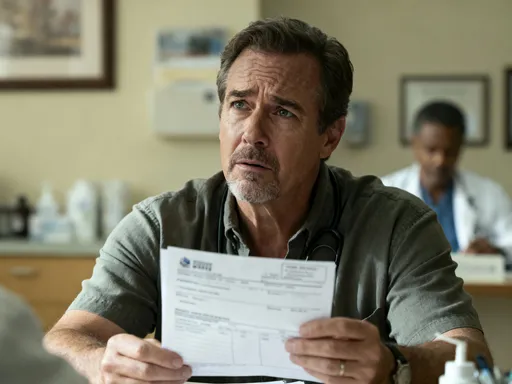

It started with a persistent ache—nothing severe, just enough to warrant a doctor’s visit. What followed was a series of tests, a diagnosis I wasn’t prepared for, and a stack of bills that arrived faster than the recovery. The diagnosis itself was manageable, but the financial impact was overwhelming. Despite having health insurance, I found myself responsible for thousands of dollars in out-of-pocket costs. The experience was a stark reminder: being insured does not mean being fully protected. For many families, especially those led by women managing household finances, medical emergencies can quietly unravel years of careful budgeting. The emotional toll was real—sleepless nights, constant worry, and the guilt of possibly burdening loved ones. But beneath the stress lay a deeper realization: I had prepared for everything except this.

Medical expenses are among the most unpredictable yet inevitable financial risks. Unlike car repairs or home maintenance, which can be scheduled or anticipated, health issues often arrive without warning. According to studies, medical bills remain a leading cause of financial distress in households, even among those with steady incomes and insurance coverage. A single hospital stay can cost tens of thousands of dollars, and specialized treatments—such as those for chronic conditions like diabetes or heart disease—can stretch financial resources over months or years. What makes this burden worse is the false sense of security many people carry. They assume their insurance will cover everything, only to discover later that deductibles, co-insurance, and excluded services leave them exposed. This gap between expectation and reality is where financial vulnerability grows.

For women in the 30 to 55 age group—often balancing caregiving, household management, and career responsibilities—this vulnerability is especially acute. Many are the primary decision-makers when it comes to family health and finances. Yet, they may not have the time or resources to deeply research medical billing systems or insurance policies. The result? A reactive rather than proactive approach to health-related costs. The wake-up call isn’t just about one bill or one diagnosis; it’s about recognizing that health and financial wellness are deeply connected. Ignoring medical costs is not a neutral choice—it’s a gamble with high stakes. And the sooner families begin planning, the better equipped they’ll be to face whatever comes their way.

Understanding Medical Expenses: What You’re Actually Paying For

To manage medical costs effectively, it’s essential to understand what they consist of. Most people see a final bill and assume it’s a single charge, but in reality, it’s a collection of line items—each with its own price tag and purpose. These typically include physician consultations, diagnostic tests (like MRIs or blood work), treatment procedures, medications, anesthesia, facility fees, and follow-up visits. What surprises many is how quickly these individual costs add up. A routine surgery, for example, may involve pre-op testing, the surgeon’s fee, the anesthesiologist’s charge, the hospital’s operating room fee, and post-op care—all billed separately. Without clear communication, patients often don’t realize they’re being charged for multiple services until the bills arrive.

One of the biggest challenges in healthcare pricing is the lack of transparency. Unlike buying groceries or electronics, where prices are clearly marked, medical costs are often hidden or negotiated behind the scenes between providers and insurers. This makes it difficult for patients to compare prices or anticipate expenses. A simple imaging test can cost hundreds or even thousands of dollars depending on the facility, yet there’s no standardized menu of prices to consult. Even insured patients face confusion, as their out-of-pocket responsibility depends on whether the provider is in-network, what their plan covers, and how much they’ve already paid toward their deductible. This complexity creates opportunities for unexpected charges, especially when patients unknowingly receive care from out-of-network specialists within an in-network hospital.

Common cost traps include emergency room visits for non-emergencies, brand-name medications when generics are available, and unnecessary repeat testing due to poor coordination between providers. For instance, going to the ER for a minor infection can result in a bill several times higher than visiting an urgent care clinic. Similarly, filling a prescription without checking for lower-cost alternatives can lead to overpaying by hundreds of dollars annually. Another hidden expense is the administrative burden—patients often spend hours on the phone disputing bills, clarifying insurance claims, or tracking down records. These time and energy costs, while not monetary, take a toll on well-being. Understanding the structure of medical billing is the first step toward gaining control. When families know what they’re paying for, they can begin to question, compare, and make informed decisions.

Why Standard Insurance Isn’t Enough

Health insurance is a critical safeguard, but it’s not a complete solution. Many people assume that having coverage means they’re protected from major expenses, but the reality is more complicated. Insurance plans come with built-in cost-sharing mechanisms—deductibles, co-pays, co-insurance, and out-of-pocket maximums—that determine how much the patient pays. A deductible is the amount a person must pay each year before insurance starts covering services. For high-deductible plans, this can be several thousand dollars. Until that threshold is met, the patient bears the full cost of most care. Co-insurance, which typically kicks in after the deductible, requires the patient to pay a percentage—often 20%—of the remaining bill. These structures mean that even with insurance, a serious illness can result in substantial out-of-pocket spending.

Different plan types also offer varying levels of protection. HMOs (Health Maintenance Organizations) usually require patients to use a specific network of providers and get referrals for specialists, but they often have lower premiums and predictable costs. PPOs (Preferred Provider Organizations) offer more flexibility in choosing doctors and specialists without referrals, but they tend to have higher premiums and broader financial exposure. High-deductible health plans (HDHPs) are increasingly common, especially through employers, and are often paired with Health Savings Accounts. While they offer lower monthly premiums, they shift more financial responsibility to the individual, especially in the early part of the year when the deductible hasn’t been met. Choosing the wrong plan for one’s health needs can lead to unexpected costs and stress.

Another limitation of standard insurance is coverage gaps. Many plans exclude or limit coverage for certain services, such as mental health care, fertility treatments, alternative therapies, or long-term care. Chronic conditions may require ongoing treatments that are only partially covered, leaving patients to pay the difference indefinitely. Prescription drug coverage can also be inconsistent, with some medications requiring prior authorization or falling into high-cost tiers. Additionally, experimental or off-label treatments are rarely covered, even if recommended by a doctor. These exclusions can force families to make difficult choices between financial stability and medical care. The key takeaway is that insurance is a tool, not a guarantee. It reduces risk but doesn’t eliminate it. Understanding the details of one’s plan—what’s covered, what’s not, and how costs are shared—is essential for avoiding financial surprises.

Building Your Financial Safety Net: The Emergency Fund That Saves Lives

One of the most effective ways to prepare for medical expenses is to build a dedicated emergency fund. This is not just a general savings account for car repairs or job loss—it’s a specific reserve for health-related costs. Financial experts often recommend saving three to six months’ worth of living expenses, but for medical planning, an additional buffer is wise. A good rule of thumb is to aim for at least $1,000 to $5,000 in liquid savings specifically for unexpected health events. For those with chronic conditions or family health histories, a larger fund may be necessary. The goal is to have accessible funds that can cover deductibles, co-pays, or urgent care visits without relying on credit cards or loans.

Creating this fund doesn’t require a high income—just consistency and intention. Even setting aside $50 or $100 per month can build meaningful protection over time. Automating transfers to a high-yield savings account makes the process easier and less dependent on willpower. It’s also helpful to treat medical savings as a non-negotiable budget item, like rent or groceries. When unexpected income comes in—a tax refund, bonus, or gift—directing a portion into the emergency fund accelerates progress. The psychological benefit is just as important as the financial one: knowing there’s a cushion reduces anxiety and allows for clearer decision-making during a crisis.

Liquidity is crucial. Unlike retirement accounts or long-term investments, emergency funds must be easily accessible. Money tied up in stocks or retirement plans may lose value if withdrawn during a market downturn, and early withdrawals can trigger penalties. A savings account in a reputable bank or credit union offers safety, quick access, and modest interest. Some families choose to keep this fund separate from their main checking account to avoid accidental spending. Over time, this fund becomes more than just a financial tool—it becomes a source of empowerment. It allows individuals to seek care when needed, rather than delaying treatment due to cost concerns. In this way, financial preparation supports not just economic stability, but better health outcomes.

Health Savings Accounts (HSAs) and Other Tax-Smart Tools

For those enrolled in high-deductible health plans, Health Savings Accounts (HSAs) are among the most powerful financial tools available. An HSA allows individuals to set aside pre-tax dollars specifically for qualified medical expenses. Contributions reduce taxable income, the funds grow tax-free, and withdrawals for medical purposes are also tax-free—making it a triple-tax-advantaged account. In 2024, the IRS allows contributions of up to $4,150 for individuals and $8,300 for families, with an additional $1,000 catch-up contribution for those aged 55 and older. These limits make it possible to build a substantial reserve over time.

What sets HSAs apart from other accounts is their flexibility and long-term potential. Unlike Flexible Spending Accounts (FSAs), which typically require use-it-or-lose-it spending by year-end, HSA funds roll over indefinitely. This means unused money continues to grow, year after year. Families can invest HSA funds in mutual funds or other options once the account reaches a certain balance, allowing for compound growth similar to a retirement account. Over decades, this can result in a significant pool of money dedicated to future healthcare needs, including those in retirement when medical expenses tend to rise.

Smart usage of an HSA includes paying current medical bills with after-tax income while leaving the HSA balance invested, effectively turning the account into a long-term health investment. Receipts should be saved for any out-of-pocket expenses, as they can be reimbursed from the HSA at any time in the future—even years later. This strategy maximizes growth potential while maintaining flexibility. FSAs, though less flexible, can still be useful for predictable expenses like prescription co-pays, vision care, or dental work. Employers may also offer dependent care FSAs or other benefits that complement medical savings. Together, these tools form a tax-efficient framework for managing healthcare costs without sacrificing financial progress.

Strategic Cost Control: How to Navigate Care Without Breaking the Bank

Once the financial foundation is in place, practical strategies can further reduce medical spending. One of the most effective is price comparison. Many hospitals, clinics, and imaging centers offer online cost estimators or are willing to provide quotes over the phone. For non-emergency procedures—such as MRIs, colonoscopies, or lab tests—shopping around can save hundreds or even thousands of dollars. Some facilities offer cash-pay discounts for uninsured or underinsured patients, which may be lower than what an insurance company is charged. Taking the time to call and compare is a small effort with potentially large returns.

Negotiating bills is another underused tactic. Medical providers often expect some level of negotiation and may offer payment plans, discounts for prompt payment, or financial assistance programs. Reviewing bills for errors is equally important—duplicate charges, incorrect codes, or services not received can all inflate costs. If an out-of-network charge appears unexpectedly, contacting the insurer and provider to resolve the issue can lead to adjustments. Many hospitals have patient advocacy or financial counseling departments that can help navigate these challenges.

Choosing in-network providers is a simple but powerful way to control costs. Staying within the network ensures the best rates and minimizes surprise bills. Telehealth services have also become a cost-effective alternative for routine consultations, follow-ups, or mental health support. They reduce travel time, missed work, and facility fees. Prescription costs can be lowered by using discount programs like GoodRx, opting for 90-day supplies, or asking doctors for generic equivalents. Seeking second opinions is not only medically prudent but financially wise—it can prevent unnecessary surgeries or treatments that carry high price tags. Together, these strategies empower families to take an active role in their healthcare spending.

Long-Term Planning: Aligning Health and Wealth Goals

Medical expense planning shouldn’t be isolated from broader financial goals—it should be woven into them. As people age, healthcare needs typically increase, making it essential to consider medical costs in retirement planning. Medicare covers many services, but it doesn’t pay for everything. Beneficiaries still face premiums, deductibles, co-pays, and uncovered services like dental, vision, and long-term care. Planning for these expenses decades in advance can prevent financial strain later. HSAs, when used strategically, can become a cornerstone of retirement health funding.

Life-stage considerations also matter. For women in their 30s and 40s, planning may include preparing for pregnancy-related care, children’s medical needs, or supporting aging parents. In the 50s, attention often shifts to preventive screenings, managing chronic conditions, and building resilience for the years ahead. Each stage presents different risks and opportunities for financial preparation. Engaging in regular financial check-ins—reviewing insurance coverage, updating emergency funds, and reassessing health goals—helps maintain alignment between health and wealth.

The ultimate goal is not to avoid illness, which is beyond anyone’s control, but to build confidence in facing it. Financial resilience means having options, reducing stress, and protecting family stability. By taking practical steps today—building savings, understanding insurance, using tax-advantaged accounts, and making informed choices—families can transform fear into preparedness. Health and financial wellness are not separate journeys; they are part of the same path. And walking that path with intention makes all the difference.