How I Tackled Chronic Illness Without Breaking the Bank – A Beginner’s Real Talk

Managing a chronic health condition felt overwhelming at first—especially the financial toll. I was drowning in bills, confused by insurance, and stressed about the future. But over time, I discovered simple, practical ways to take control. It wasn’t about quick fixes, but smart, sustainable choices. Now, I’m sharing what worked for me, the mistakes I made, and how I found balance between health and finances—so you don’t have to learn the hard way. This is not a miracle story. There were setbacks, difficult months, and moments of doubt. But through patience, planning, and persistence, I built a life that supports both my well-being and my budget. If you're facing a similar journey, know this: you are not alone, and relief is possible.

The Shock of the Diagnosis: When Health Meets Financial Reality

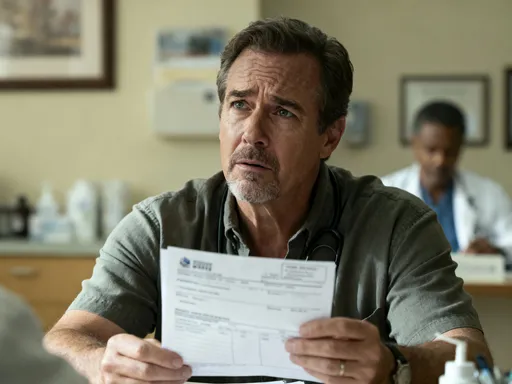

The day started like any other—morning coffee, a quick check of emails, and a routine doctor’s visit I had scheduled weeks earlier. I wasn’t feeling terribly unwell, just a persistent fatigue and occasional joint pain I’d been brushing off as stress. But the blood work told a different story. Within days, I was sitting across from a specialist hearing words I never expected: a diagnosis of a chronic autoimmune condition. In that moment, my world shifted. The emotional weight was immense—fear, confusion, grief for the life I thought I’d have. But almost as quickly, another reality set in: the financial one.

Within the first month, I received my first stack of medical bills. There were charges for the specialist visit, lab panels, imaging scans, and follow-up appointments. Some were covered, but many came with co-pays, deductibles, and unexpected fees. I had insurance, yes, but it wasn’t designed for ongoing, long-term care. I began to realize that managing a chronic illness wasn’t just about treatment—it was about managing a second job: medical administration and financial navigation. Lost income added to the strain. I couldn’t work full-time during flare-ups, and my employer didn’t offer robust sick leave. The combination of reduced earnings and rising expenses created a perfect storm.

What made it worse was the uncertainty. How much would this cost next year? Would my condition worsen? Could I afford new treatments if needed? These questions gnawed at me, feeding anxiety that only made my symptoms feel heavier. I wasn’t alone in this. Studies show that nearly half of adults with chronic conditions report financial hardship due to medical costs. Yet, no one had prepared me for this part of the journey. The healthcare system assumed I understood billing codes, insurance tiers, and prescription formularies. I didn’t. And that lack of knowledge only deepened my sense of helplessness. It was clear that if I wanted to regain control, I needed to become fluent in the language of health and finance—not just medicine.

Understanding the Hidden Costs of Chronic Disease Management

At first, I thought my main expenses would be doctor visits and prescriptions. I was wrong. The true cost of chronic illness is a mosaic of small, recurring charges that quietly accumulate into a significant burden. Take prescription co-pays, for example. Even with insurance, some medications required $30 to $50 per month. That might sound manageable—until you’re on three or four medications. Suddenly, that’s $150 a month, every month, with no end in sight. And when one drug stopped working and needed to be replaced with a newer, more expensive option, the cost jumped again.

Then there were the specialist visits. My primary care provider referred me to a rheumatologist, a physical therapist, and a nutritionist. Each required separate appointments, each with its own co-pay and travel cost. Lab tests became routine—sometimes monthly—and while insurance covered part of it, the remainder still added up. I began tracking these expenses and was stunned to find I was spending over $400 a month on healthcare-related costs, not including what I paid out-of-pocket for things insurance wouldn’t touch.

Those uncovered items were the real shock. Things like compression garments, special supplements recommended by my doctor, heating pads, ergonomic furniture, and even parking fees at the medical center. Over-the-counter pain relievers, digestive aids, and sleep support products became staples in my household. I started keeping receipts and was shocked to see how quickly $10 here and $20 there turned into hundreds per year. Transportation was another silent cost. Public transit wasn’t always accessible, and rideshares added up—especially when I needed to travel to a medical center an hour away.

What many don’t realize is that insurance, even good insurance, is designed for acute care—not long-term management. It covers the emergency, the surgery, the short-term treatment. But for chronic conditions, the system often leaves patients to fend for themselves on the ongoing costs. I learned that the average person with a chronic illness spends 2.5 times more on out-of-pocket medical expenses than someone without. These aren’t one-time costs; they’re permanent line items in a household budget. Recognizing this was the first step toward taking control. I couldn’t change my diagnosis, but I could change how I responded to its financial impact.

Insurance: Navigating the Maze Without Losing Your Mind

If there’s one thing that causes more stress than a chronic illness itself, it’s trying to understand health insurance. The terminology alone—deductibles, co-insurance, out-of-pocket maximums, formularies, prior authorizations—feels like a foreign language. I remember staring at my first Explanation of Benefits (EOB) statement, convinced it was written in code. Charges were listed with cryptic numbers, percentages, and notes like “not covered under plan.” I felt powerless, as if someone else was deciding what I could and couldn’t afford.

But I decided to treat insurance like a skill to learn, not a barrier to endure. I started by requesting a full summary of my benefits from my insurer. I read it cover to cover. I learned that my deductible was $3,000—a figure I hadn’t fully grasped before. That meant I had to pay that amount out of pocket before insurance would begin covering most services at a higher rate. I also discovered that my medications were categorized into tiers, and the one I was prescribed was Tier 4, which meant higher co-pays. None of this had been explained to me during enrollment.

Armed with this knowledge, I began advocating for myself. I learned how to call customer service and ask specific questions: “Is this lab test covered?” “Is there a lower-tier alternative to my medication?” “What’s the process for a prior authorization?” I kept notes, recorded call times, and asked for case managers. When a claim was denied, I didn’t accept it. I filed an appeal, submitted medical records, and within weeks, had it reversed. That single appeal saved me over $200.

I also learned the importance of choosing the right plan. During open enrollment, I didn’t just pick the cheapest option. I projected my expected medical needs—how many visits, labs, and prescriptions I’d likely need—and compared plans based on total estimated cost, not just the monthly premium. A slightly higher premium with lower co-pays and better drug coverage ended up saving me hundreds over the year. I also looked into supplemental insurance and patient assistance programs offered by pharmaceutical companies. Many offer income-based discounts or even free medication for qualifying patients. The key was being proactive—reading the fine print, asking questions, and not assuming that the first answer was the final one.

Budgeting for Health: Building a Financial Safety Net

Once I had a clearer picture of my ongoing medical costs, I faced a hard truth: my current budget couldn’t sustain it. I had to make changes. The first step was creating a detailed household budget that included healthcare as a fixed monthly expense—just like rent or utilities. I listed every known cost: insurance premiums, co-pays, prescriptions, supplements, transportation, and even estimated lab fees. Seeing it all in one place was sobering, but it gave me clarity.

I then looked for areas to adjust. I didn’t cut essentials, but I re-evaluated discretionary spending. Dining out went from three times a week to once. I canceled subscription services I rarely used. I started meal planning to reduce grocery waste and save on food costs. These changes weren’t drastic, but together, they freed up about $150 a month—money I redirected into a dedicated “health reserve fund.” This fund wasn’t for emergencies like hospitalizations—those were covered by insurance—but for predictable, recurring costs that insurance didn’t fully cover.

Building this fund took time. I started small—$25 a month—then increased it as I found more savings. Within a year, I had over $1,500 set aside. That buffer gave me peace of mind. When an unexpected co-pay came up or a supplement wasn’t covered, I didn’t have to scramble. I also began prioritizing expenses differently. Instead of viewing medical costs as a burden, I reframed them as an investment in my ability to function, work, and enjoy life. This mindset shift helped me stay committed to saving, even when it felt tight.

I also explored income-boosting options. I took on freelance work during stable periods, sold unused items online, and looked into community programs that offer financial assistance for people with chronic conditions. Some local nonprofits provide grants for medication costs or transportation to appointments. I applied and was approved for a small stipend that helped cover parking and rideshare fees. These resources exist, but you have to seek them out. Budgeting for health isn’t just about cutting—it’s about being resourceful, creative, and persistent.

Smart Treatment Choices: Balancing Cost and Care Quality

One of the most empowering realizations I had was this: being cost-conscious doesn’t mean compromising care. In fact, it can lead to better outcomes. I used to assume that the newest, most expensive treatment was automatically the best. But after talking with my doctor and doing research, I learned that wasn’t always true. Many generic medications are just as effective as their brand-name counterparts, with identical active ingredients. My rheumatologist confirmed that switching to a generic version of my medication wouldn’t affect my treatment—and it cut my monthly cost in half.

I also learned the value of asking questions during appointments. Instead of accepting a prescription blindly, I started saying, “Is there a lower-cost alternative?” or “Is this test absolutely necessary right now?” My doctor appreciated the conversation. In one case, we delayed a non-urgent imaging scan and used the savings to cover a physical therapy session that was more immediately beneficial. I also sought second opinions when recommended treatments were extremely costly. In one instance, a second specialist suggested a different approach that was equally effective but far more affordable.

Another strategy was consolidating appointments. Instead of separate visits for labs and consultations, I asked if they could be scheduled on the same day. This reduced travel costs and time off work. I also looked into mail-order pharmacies, which often offer lower prices and free shipping for maintenance medications. Some even provide a 90-day supply at the cost of two months, which meant fewer refills and lower overall spending.

The goal wasn’t to avoid care—it was to make informed, intentional decisions. I kept a treatment journal, noting how I responded to medications, therapies, and lifestyle changes. This helped me and my doctor identify what truly worked, so we could avoid wasting money on ineffective treatments. Being an engaged, educated patient gave me more control and reduced financial stress. I wasn’t just following orders—I was partnering in my care, with both health and budget in mind.

Income Protection and Long-Term Planning: Thinking Beyond the Next Bill

For a long time, I focused only on the immediate costs—this month’s prescription, next week’s appointment. But I eventually realized I needed to look further ahead. Chronic illness can affect earning potential, especially if symptoms limit your ability to work full-time or pursue career advancement. I had to confront the possibility that my income might never return to pre-diagnosis levels. That’s when I started thinking about income protection and long-term financial planning.

I reviewed my employer’s disability insurance options and enrolled in long-term disability coverage. It wasn’t cheap, but the peace of mind was worth it. I also looked into individual policies to supplement what my employer offered. Knowing I’d have some income if I couldn’t work reduced a major source of anxiety. I also explored flexible work arrangements—remote work, part-time hours, freelance opportunities—that allowed me to earn while accommodating my health needs.

I also began protecting my credit. I set up automatic payments for medical bills to avoid late fees and negative marks on my report. When I couldn’t pay in full, I called providers and asked for payment plans—most offered them with no interest. I also monitored my credit score regularly and disputed any errors. A strong credit score meant better loan terms and more financial flexibility if I ever needed to borrow.

Long-term planning included setting savings goals—like building an emergency fund, saving for future treatments, and even thinking about retirement. I met with a fee-only financial planner who specialized in working with people with chronic conditions. They helped me create a realistic roadmap that accounted for both my health and financial realities. We discussed advance directives, including a medical power of attorney, so my wishes would be respected if I couldn’t communicate them. These steps weren’t about pessimism—they were about preparation, dignity, and control.

Lessons Learned: How I Regained Control—And You Can Too

Looking back, this journey has been one of the hardest things I’ve ever faced. There were months when I felt defeated, when the bills piled up and my body felt like it was betraying me. But there were also victories—small at first, then bigger. Paying a bill without panic. Getting a claim approved. Finding a treatment that worked. Saving enough to cover a surprise expense without borrowing. These moments added up, not just in dollars, but in confidence.

I learned that managing a chronic illness is not just a medical challenge—it’s a financial and emotional one too. But it doesn’t have to be a life sentence of stress and scarcity. With the right strategies, support, and mindset, it’s possible to build a life that honors both your health and your financial well-being. You don’t need to be an expert to start. You just need to take one step: read your EOB, adjust your budget, ask a question at your next appointment. Progress isn’t linear, but every small action builds resilience.

Today, I still have my condition. But I no longer feel controlled by it. I’ve created systems that work for me—a health reserve fund, a trusted care team, a budget that includes medical costs, and a plan for the future. I’ve learned to advocate for myself, to prioritize what matters, and to find strength in the process. If you’re just beginning this journey, know that you don’t have to have all the answers. You just need to start. And you don’t have to do it alone. There are resources, communities, and professionals ready to help. Take it one day, one decision, one step at a time. Your health—and your peace of mind—are worth it.