How I Kept My Cool When the Paycheck Stopped — A Real Cost Control Journey

Losing a job doesn’t mean losing control. When my income suddenly stopped, panic kicked in — until I took a breath and started tracking every dollar. What I discovered wasn’t just how to survive, but how to reset my finances with clarity. This is the real talk on staying steady when work disappears, with practical moves that actually work. No fluff, no jargon — just what helped me regain peace when it mattered most. In those first quiet days without a paycheck, I realized something powerful: financial stability isn’t only about how much you earn, but how well you manage what you have. This journey wasn’t about dramatic income leaps or lucky breaks. It was about discipline, awareness, and the quiet strength of making smart choices when it felt easier to give in to fear.

The Moment It All Changed

The call came on a Tuesday afternoon. The tone was polite, the message clear: the company was restructuring, and my role was being eliminated. There was no warning, no gradual decline — just silence where a paycheck used to be. In the hours that followed, my mind raced through worst-case scenarios. How long could the savings last? Could I still pay the mortgage? What if no job came soon? The emotional weight was heavy, not just because of the financial hit, but because of what it represented — loss of routine, identity, and security. I felt untethered, as if the ground beneath me had shifted without notice.

For two full days, I did nothing. Not out of laziness, but out of shock. It was easier to scroll through job boards aimlessly than to face the numbers. But avoidance only deepened the anxiety. I knew I had to act, not react. The turning point came when I opened my last bank statement and began writing down every expense from the past month. It wasn’t glamorous, but it was grounding. That simple act — putting pen to paper — shifted my mindset from victim to strategist. I realized that while I couldn’t control the job market, I could control my spending. And that small realization became the foundation of my recovery.

This experience taught me that job loss is not just an economic event — it’s an emotional one. The fear of uncertainty can be paralyzing, but it doesn’t have to be defining. What mattered most wasn’t how quickly I found another job, but how quickly I regained control over my financial life. By acknowledging the emotional toll and choosing action over inertia, I set myself on a path not just to survival, but to transformation. The journey ahead wasn’t about returning to how things were — it was about building something stronger, leaner, and more resilient than before.

Why Cost Control Beats Panic

When income stops, the natural instinct is to fix the inflow — to hunt for any job, take on odd gigs, or even consider high-risk financial moves. But in my experience, the most effective first step wasn’t chasing money; it was stopping the bleed. Panic leads to poor decisions: applying for high-interest personal loans, maxing out credit cards for non-essentials, or accepting a job that pays poorly and drains energy. These reactions only deepen the financial hole. In contrast, cost control provides immediate relief. It creates breathing room, reduces pressure, and buys time to make thoughtful choices.

Think of your finances like a sinking boat. The instinct might be to swim faster, but the smarter move is to patch the holes first. Every dollar saved is a dollar that doesn’t need to be earned. This shift — from focusing solely on income to managing outflow — is what separates financial survival from long-term stability. For example, I realized I was paying $18 a month for a cloud storage service I barely used. It seemed small, but when I reviewed all such subscriptions, the total came to over $120 a month. That’s more than a car payment. Cutting those expenses didn’t require a new job — just awareness and a few minutes online.

Another common trap is the belief that cutting costs means drastic lifestyle changes. But that’s not true. Cost control isn’t about deprivation; it’s about intentionality. It means asking, “Does this expense serve my current reality?” When I asked that question, I downgraded my phone plan, canceled a streaming service I only watched once a month, and paused my gym membership in favor of home workouts. None of these felt like sacrifices — they felt like smart adjustments. The psychological benefit was just as important as the financial one. Each cut boosted my confidence, reminding me that I still had agency.

Over time, this approach changed how I viewed money. Instead of seeing myself as powerless, I began to see opportunities for control. And that mindset shift made all the difference. When the next job offer came, I wasn’t desperate. I could evaluate it based on fit, not just pay. That’s the real power of cost control: it doesn’t just save money — it restores dignity and decision-making power.

The First 72-Hour Financial Triage

In medicine, triage means prioritizing care based on urgency. The same principle applies to finances after job loss. The first 72 hours are critical — not for finding a new job, but for stabilizing your financial situation. My own triage began with a simple list: essential expenses, upcoming bills, and financial obligations with penalties for late payment. I printed my bank statements, highlighted due dates, and categorized everything into three groups: must-pay, can-wait, and can-cut. This visual map gave me clarity and prevented decision fatigue later.

One of the first actions I took was contacting my mortgage lender. I explained my situation and asked about forbearance options. To my relief, they offered a three-month pause with no penalty. I did the same with my car loan and credit card companies. Not all agreed, but several offered temporary payment plans or interest rate reductions. The key was acting early — before a single payment was missed. Waiting until the last minute reduces your options and increases stress. By reaching out proactively, I maintained my credit standing and avoided late fees that could have worsened the situation.

I also paused my retirement contributions. This wasn’t ideal, but it was practical. With no steady income, continuing to contribute would have strained my cash flow. I redirected that money toward essentials like groceries and utilities. I didn’t stop thinking about retirement — I just adjusted the timing. Similarly, I froze any non-essential spending. That meant no dining out, no online shopping, no impulse purchases. I even turned off shopping app notifications to reduce temptation. These small moves added up quickly.

Another crucial step was reviewing insurance policies. I compared my auto and home insurance rates and switched to a lower-cost provider, saving nearly $40 a month. I also checked if I qualified for unemployment benefits and applied the same day. It took time to process, but every dollar helped. By the end of the 72 hours, I had a clear picture of my financial runway. I knew how long my savings would last, which bills were secured, and where I had flexibility. That knowledge didn’t eliminate stress, but it replaced chaos with structure — and that was half the battle.

Building a Leaner Monthly Budget That Actually Works

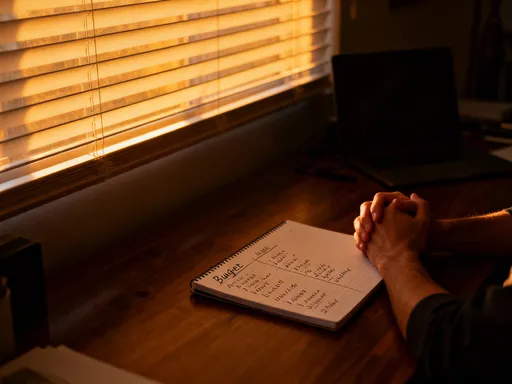

After the initial triage, I needed a sustainable plan — a budget that reflected my new reality, not my old life. I started by calculating my bare minimum monthly needs: rent, utilities, groceries, transportation, and insurance. I called this my “survival baseline.” Everything else — entertainment, subscriptions, dining — was temporarily suspended. My goal wasn’t comfort; it was sustainability. I wanted to know exactly how little I could live on without sacrificing health or dignity.

To make this budget realistic, I tracked every expense for two weeks. I used a simple spreadsheet, logging every dollar spent, no matter how small. What I discovered surprised me. I was spending an average of $9 a day on coffee and snacks — over $270 a month. That was more than my electric bill. I replaced those purchases with homemade alternatives. I also switched grocery stores, moving from a premium chain to a discount supermarket. The quality was still good, but the prices were significantly lower. I began buying in bulk for non-perishables, using store loyalty programs, and shopping with a list to avoid impulse buys. These changes alone saved me over $150 a month.

Housing was my largest expense, so I explored options to reduce it. I considered moving, but the costs of relocation made it impractical. Instead, I talked to my landlord about a temporary rent reduction. While he couldn’t lower the rate, he agreed to let me pay half now and half later, which eased the monthly burden. I also looked into refinancing my mortgage, but given the short-term nature of my job loss, it didn’t make sense. Still, researching it helped me understand my options.

The most powerful part of this process was creating a “bare-bones buffer” — a monthly target that covered only the essentials. Mine was $2,100. As long as I stayed under that, I knew I was safe. This number became my financial guardrail. It wasn’t about hitting it perfectly every month, but about staying aware. When I did go over, I reviewed why and adjusted. Over time, this budget became a tool for empowerment, not restriction. It showed me that I could live well — not lavishly, but securely — on less than I thought possible.

Income Gaps vs. Spending Leaks: Which Hurts More?

Most people assume that the biggest threat during unemployment is the lack of income. But in my experience, uncontrolled spending is often the greater danger. An income gap is temporary — it ends when you find work. But a spending leak can persist long after employment returns, trapping people in debt even with a steady paycheck. I’ve seen friends land new jobs quickly but remain financially stressed because they kept their old spending habits. The truth is, reducing outflow is faster, more predictable, and entirely within your control.

Consider this scenario: two people lose their jobs at the same time. Person A panics and continues spending as before, relying on credit cards. Person B cuts non-essentials, negotiates bills, and lives on a lean budget. Both eventually find work. But Person A starts the new job already in debt, with interest accruing and credit damaged. Person B starts with clean finances and a stronger foundation. Who is in a better position long-term? The answer is clear. Cost discipline doesn’t just help during unemployment — it sets the stage for future success.

Another way to think about it is speed of impact. Earning an extra $500 a month requires finding a new job or side gig, which can take weeks or months. But cutting $500 in expenses can happen in a single week. I did it by reviewing my monthly outflows and eliminating redundancies. For example, I had two internet services — one for home and one for mobile hotspot. I canceled the hotspot and relied on public Wi-Fi when needed. That saved $60 a month. I also switched to a cheaper phone plan with a smaller data allowance, saving another $35. These weren’t huge sacrifices, but they added up fast.

The lesson here is that financial resilience isn’t built on income alone. It’s built on balance — between earning and spending, between needs and wants. During unemployment, focusing on spending gives you immediate power. It reduces the pressure to accept the first job offer, no matter how poor the fit. It allows you to wait for something better. And when income does return, you’re not just recovering — you’re rebuilding smarter. That’s why I now see cost control not as a crisis response, but as a core financial skill.

Smart Swaps and Silent Savings: Everyday Hacks That Add Up

Cost control doesn’t require extreme measures. Lasting change comes from small, consistent choices — the kind that barely register day to day but create significant savings over time. I call these “silent savings” because they work quietly in the background, reducing expenses without disrupting life. One of the most effective was batch-cooking meals on weekends. I’d prepare large portions of soups, stews, and grains, then freeze them in individual containers. This eliminated the temptation to order takeout on busy or tired evenings. The savings? Over $200 a month, plus better nutrition.

Another powerful swap was using the public library. I had been paying for audiobooks, magazines, and online courses. But my local library offered all of these for free with a library card. I borrowed audiobooks for my commute, accessed digital magazines through their app, and even took free online classes in budgeting and personal development. This wasn’t just about saving money — it enriched my time in unemployment, helping me grow instead of stagnate. The total monthly savings from canceling paid subscriptions? Nearly $80.

I also learned to time purchases with natural discount cycles. For example, I waited until back-to-school season to buy household items like soap and cleaning supplies, when retailers often mark them down. I used price-tracking tools to monitor essentials and bought in bulk when prices dipped. I started using cashback apps for necessary purchases, earning small rebates on groceries and gas. None of these required extra effort, but they added up. Over six months, these silent savings totaled over $1,200 — money that helped me stay afloat without earning a single extra dollar.

The key to making these swaps stick was consistency, not perfection. I didn’t need to do everything perfectly every day. I just needed to make better choices more often than not. And over time, those choices became habits. I no longer saw frugality as deprivation — I saw it as strategy. Each small win built confidence and momentum, proving that I could control my finances, even in uncertainty.

From Survival Mode to Financial Clarity

Looking back, losing my job was one of the hardest experiences of my adult life. But it was also one of the most transformative. The months without a paycheck forced me to confront my relationship with money in a way I never had before. I learned that financial stability isn’t about a title or a salary — it’s about awareness, discipline, and the courage to make hard choices. What began as a crisis became a foundation for lasting change.

Today, I still live by the lean budget I created during that time. Not because I have to, but because I choose to. I’ve kept the habits that worked: tracking expenses, questioning every subscription, and prioritizing needs over wants. I’ve also rebuilt my emergency fund, this time with a larger cushion. When I eventually returned to work, I didn’t revert to old spending patterns. Instead, I used the experience to redefine success — not by how much I earn, but by how well I manage.

The most valuable lesson was this: unemployment doesn’t define your financial health. Your response does. Panic leads to poor decisions. Clarity leads to control. And control leads to peace. Every person faces financial uncertainty at some point. What matters is not the event itself, but how you meet it. You don’t need a high income to be financially resilient. You need awareness, a plan, and the willingness to act — one mindful choice at a time.

This journey taught me that stability isn’t found in a paycheck. It’s built in the quiet moments — when you choose to review a bill, cook a meal at home, or pause before spending. It’s in those small acts of intention that true financial strength grows. And if I can do it, so can you. The path from crisis to clarity isn’t easy, but it is possible. It starts not with luck, but with a single decision: to take control, one dollar at a time.